idaho vehicle sales tax calculator

This guide is for individuals leasing. Sales Tax Rule 044 046 106 and 107 Sales Price.

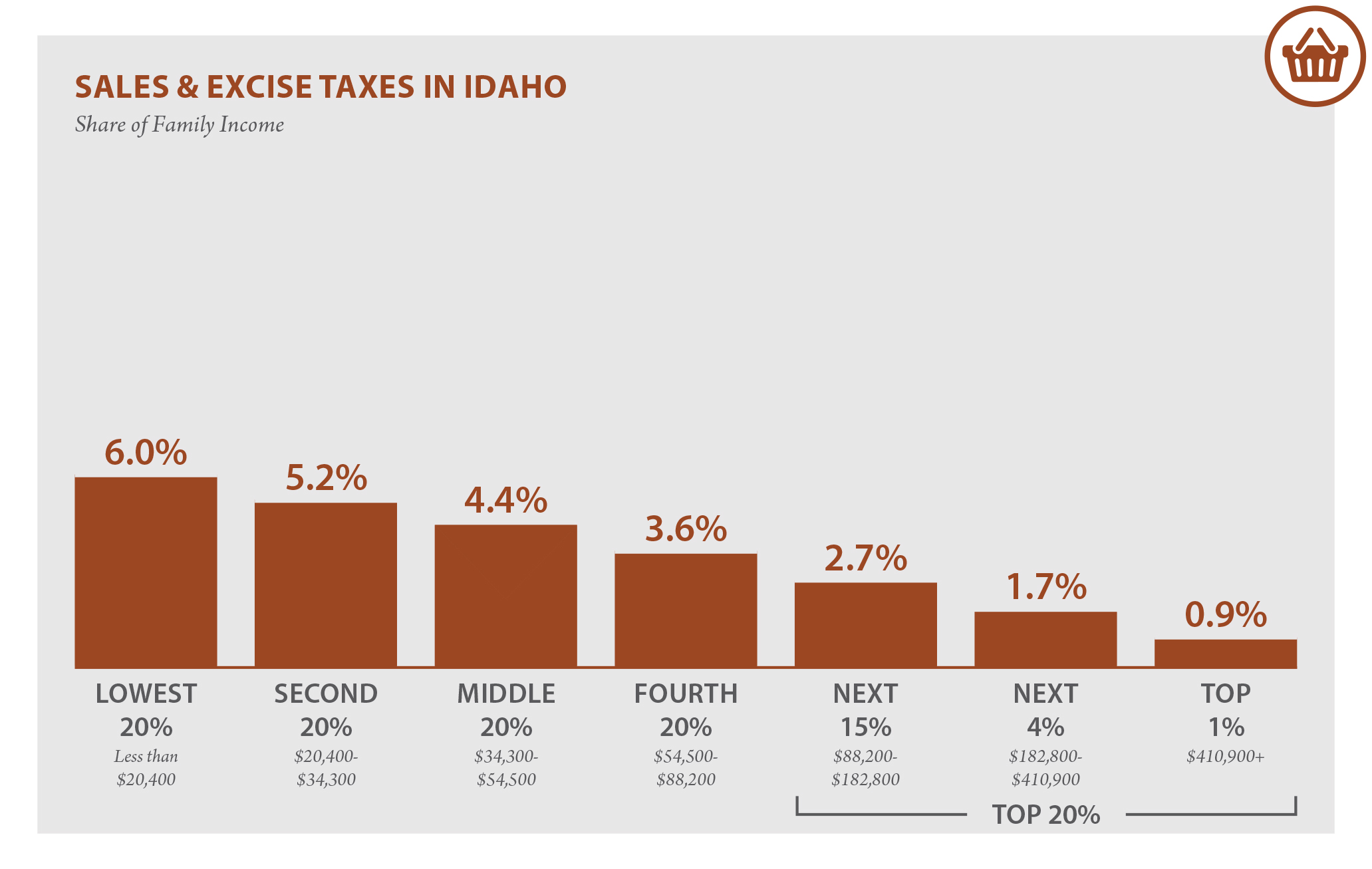

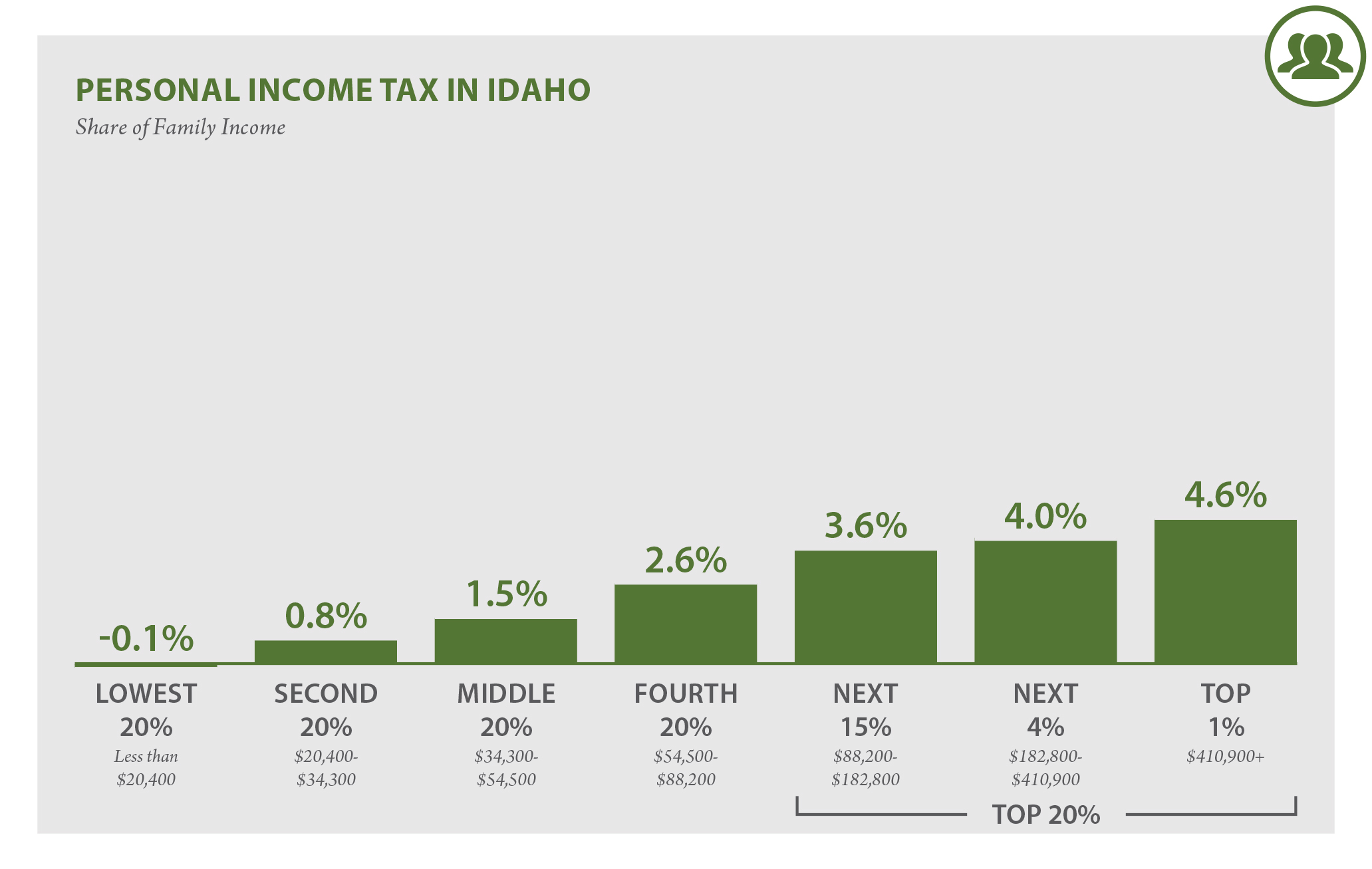

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

You are able to use our Idaho State Tax Calculator to calculate your total tax costs in the tax year 202122.

. For example imagine you are purchasing. The state sales tax rate in Idaho is 6000. You can always use Sales Tax calculator at the front.

So whilst the Sales Tax Rate in Idaho is 6 you can actually pay anywhere between 6 and 9 depending on the local sales tax rate applied in the municipality. In addition to taxes car purchases in. Idaho Code section 63-3612.

The amount allowed on the traded-in merchandise reduces the sales price which is the. You can accept merchandise as full or partial payment of a motor vehicle you sell. Idaho collects a 6 state sales tax rate on the purchase of all vehicles.

Sales or use tax is due on the sale lease rental transfer donation or use of a motor vehicle in Idaho unless a valid exemption applies. Pay the Idaho retailer tax on the sales price of the motor vehicle. Calculating Sales Tax Summary.

Additional taxes depending on your location or the data may be outdated. Our calculator has recently been updated to include both the latest Federal Tax Rates. Your household income location filing status and number of personal.

Sales tax of less than 6 and the purchase occurred within the time period noted above you owe Idaho use tax on the difference. With local taxes the total sales tax rate is between 6000 and. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

You calculate the taxable sales price for a lease of a motor vehicle the same as the sale of a motor vehicle. How to Calculate Idaho Sales Tax on a Car. For purposes of vehicle.

Car Tax By State Usa Manual Car Sales Tax Calculator Paid directly to the dealer and. And special taxation districts. Idaho has a 6 statewide sales tax rate but also has.

Sales Tax calculator Idaho. Some states provide official vehicle registration fee. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

You can view your local Idaho sales tax rates using TaxJars sales tax calculator. Free calculator to find the sales tax amountrate before tax price and after-tax price. This guide explains sales and use tax requirements for motor vehicle dealers.

If you paid a US. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Sales Tax Rate s c l sr.

The retailer will forward the tax to the Tax Commission. Our free online Idaho sales tax calculator calculates exact sales tax by state county city or ZIP code. With local taxes the total sales tax rate is between 6000 and 8500.

For vehicles that are being rented or leased see see taxation of leases and rentals. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. 6 is the lowest possible tax rate Pocatello Idaho7 8 85 is all other possible sales tax rates of Idaho.

Make sure the retailer gives you a completed title to.

States With Highest And Lowest Sales Tax Rates

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Dmv Fees By State Usa Manual Car Registration Calculator

Idaho Sales Tax Small Business Guide Truic

How Is Tax Liability Calculated Common Tax Questions Answered

Idaho Who Pays 6th Edition Itep

Dmv Idaho Transportation Department

What S The Car Sales Tax In Each State Find The Best Car Price

Dmv Idaho Transportation Department

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Dmv Idaho Transportation Department

Idaho Who Pays 6th Edition Itep

State And Local Sales Tax Deduction Remains But Subject To A New Limit Marks Paneth

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price